In a world defined by constant change — from economic shifts to rapid technological advances — Canada stands out as a stable foundation for long-term growth. Its strong institutions, transparent markets, and resilient economy distinguish it in an increasingly complex global landscape.

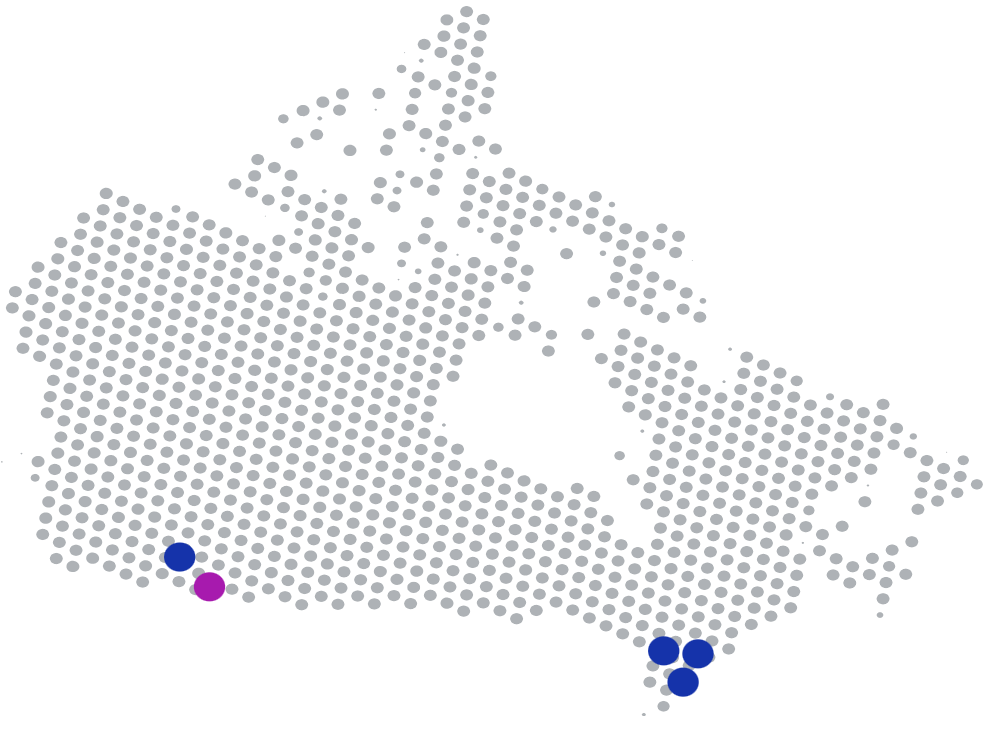

For CPP Investments, this reinforces the value of our Canadian origins. Canada is home, a market we know intimately and have supported for more than 25 years. As of March 31, 2025, we have $114 billion invested in Canada — few institutional investors have committed more.

“We continue to see Canada as one of the best places in the world to put capital to work. Our country offers what long-term investors value most: stability, transparency, and opportunity,” says our President and CEO John Graham.

Our strategic commitment to Canada

While our portfolio spans the globe, we continue to find compelling, long-term opportunities in Canada — investing more in Canada than its share of the world economy would suggest. This reflects our deep roots within the country, as well as its regulatory strength, innovation-driven economy, and institutional stability, all of which support confident, long-term investing. As a result, Canada remains home to a significant share of the CPP Fund.

All our global investments, including those in Canada, are reinvested into the CPP Fund to help provide Canadians financial security in retirement. Our domestic portfolio spans a broad range of industries that are vital to the country’s future — including energy and resources, telecommunications, technology, and professional services.

While our core objective is to manage the CPP Fund in the best interests of contributors and beneficiaries, these investments also strengthen the Canadian economy. By supporting the development of key sectors, we’re contributing to long-term economic resilience and growth across the country.